| User Roles |  Admin Admin |  Staff contributor Staff contributor |  External Contributor External Contributor | ✗Pulse user |

Use this guide to enable retained earnings calculation for client files with a Belgian address. This article is intended for firms operating in the UK, Netherlands, and Luxembourg, where retained earnings calculations are required.

Table of contents

- Why is retained earnings disabled for Belgian client files?

- How do I enable retained earnings for a Belgian client file?

- Retained earnings in sync files versus manual files

- Good to know

Why is retained earnings disabled for Belgian client files?

- Belgian companies typically do not require retained earnings calculations. For that reason, retained earnings are disabled by default for client files with a Belgian address.

- This can cause issues for firms that use retained earnings in other markets, such as the UK, the Netherlands, or Luxembourg. If a company is registered in Belgium but has business activity in one of these markets, the retained earnings calculation is blocked by default.

- To support these scenarios, you can manually enable retained earnings for specific Belgian client files.

How do I enable retained earnings for a Belgian client file?

Steps

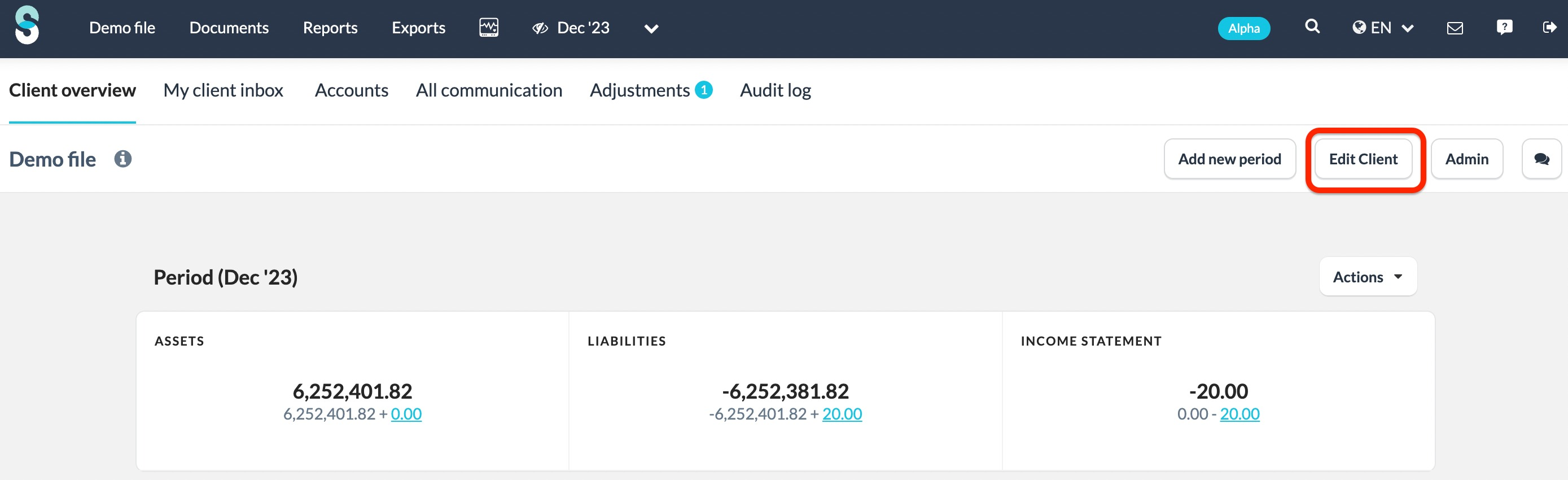

- Navigate to the Edit client button on the client file overview page.

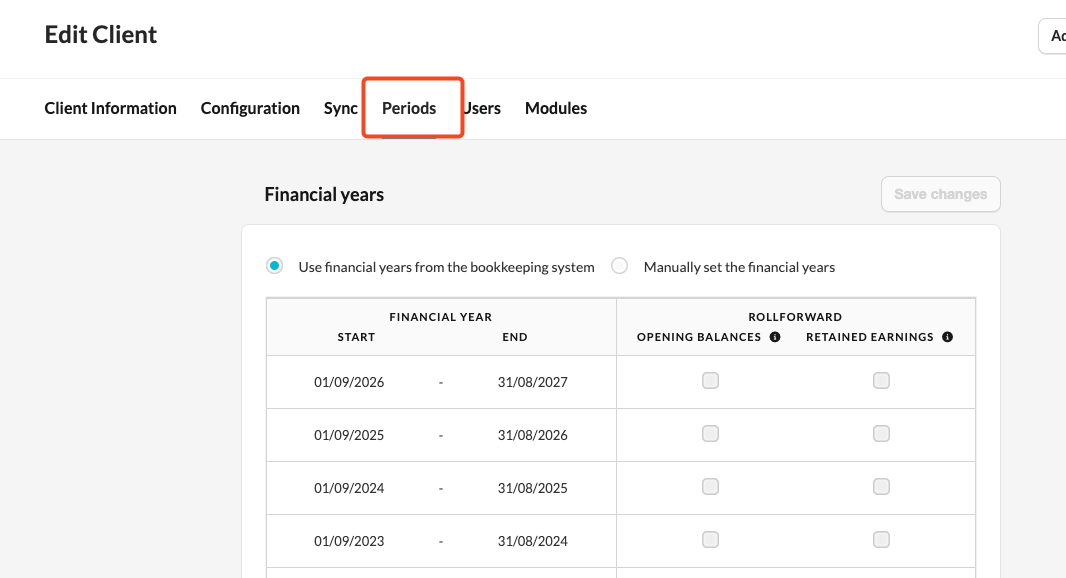

- Click on the Periods tab.

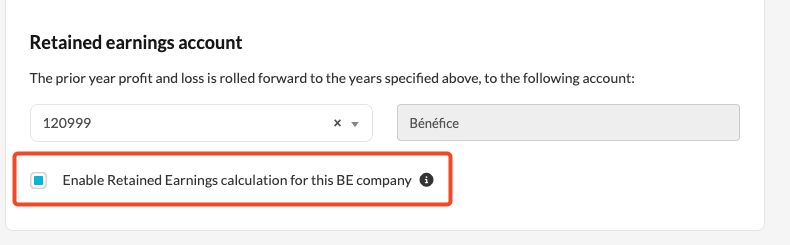

- Scroll down to the Retained earnings account section.

- Select the checkbox Enable the retained earnings calculation for this BE company.

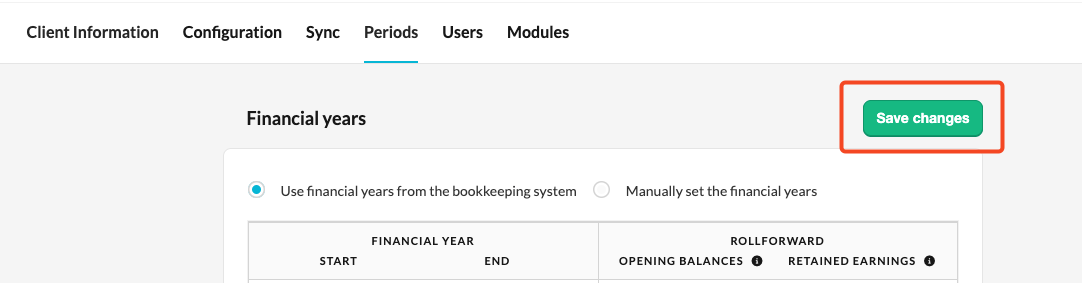

- Click Save changes.

Retained earnings in synced versus manual client files

For synced client files such as Odoo or Xero:

- The retained earnings account is assigned automatically.

- The calculation runs after you save your changes.

For manual client files:

- After enabling the checkbox, select the retained earnings account from the dropdown.

- A new Retained earnings column then appears in the periods table.

- Choose the years for which you want to run the calculation.

Note: Processing time depends on the size of the client file.

Good to know

- This option is only visible when retained earnings are available in your firm and the client file has a Belgian address.

- The checkbox is unchecked by default for all Belgian client files.

- This feature is designed for firms operating across multiple markets where a company is registered in Belgium but still requires retained earnings calculation.